The Edge – Energy Market Reports (Jan – Mar 2021)

Q1 2021 The Edge – Energy Market Reports topics

Energy Edge has recently published The Edge – Energy Market reports.

21 January 2021 Edge Report (Subscriber Link)

- Christmas Day 2020 record LNG Exports with 26.931mtpa (annualised rates) with December averaged 25.52mtpa rate.

- International Gas price have experienced a wild ride from USD$2.00/mmbtu during April 2020 to reported spot trades at USD$39.30/mmbtu

- European Gas Storage neared record gas in storage prior to the Northern winter 2020/21, but recently extracting gas at ~10GWh/d.

- Iona gas storage facility has been injecting gas into storage at seasonal highs aligning with long-term lows for domestic gas generation.

5 February 2021 Edge Report (Subscriber Link)

- APLNG revenue update with Origin Calculated Q4 income of $341M against reported $333M.

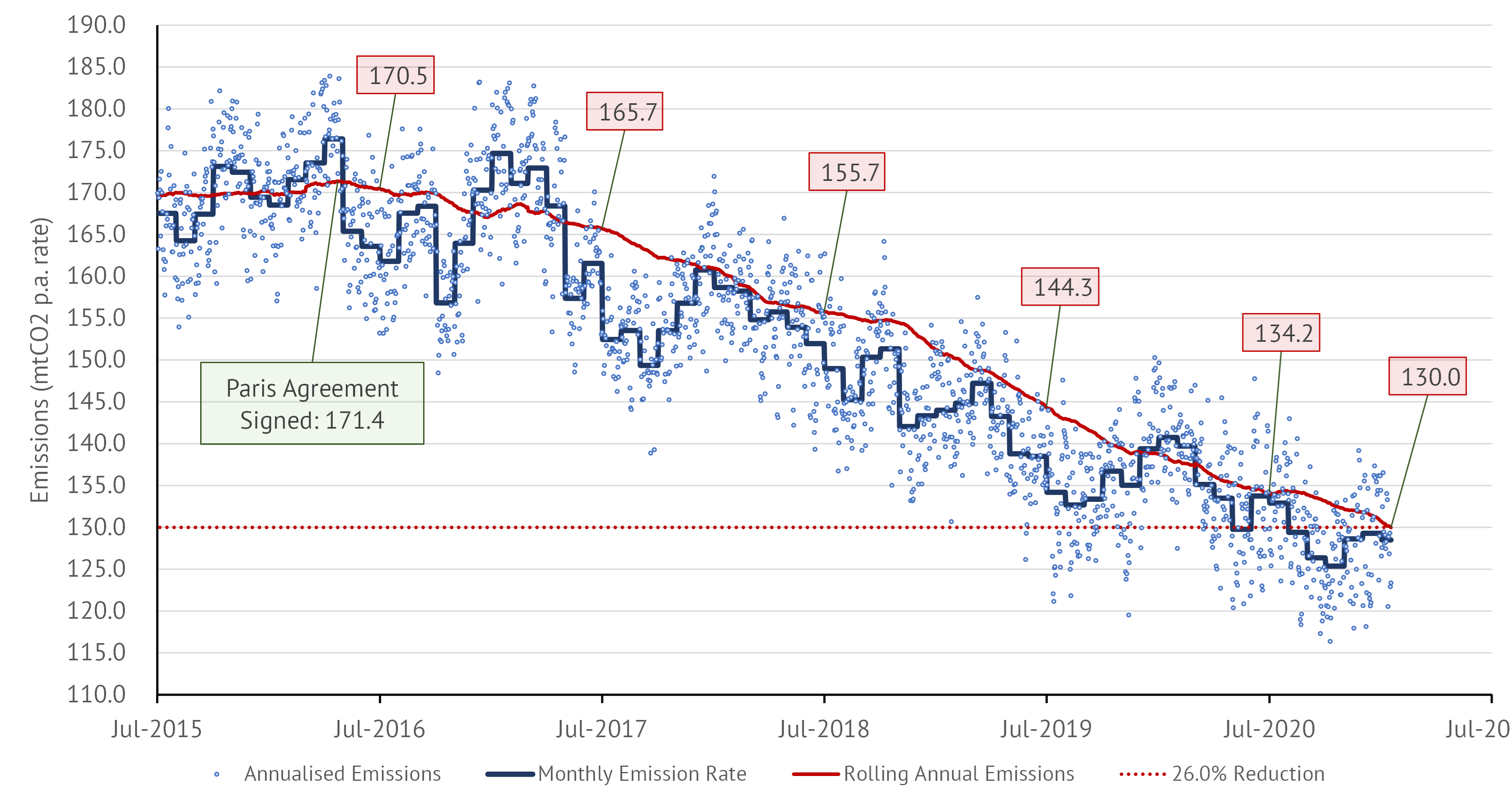

- Australian National Electricity Market (NEM) Carbon Emissions have fallen to 130.0 mtpa (as at 17th January 2021), this is down 41.4mtpa since April 2016 (171.4mtpa).

- We investigated some of the divergence in the data compared with the DISER reported figures (which include WA and NT) but there remains another systemic difference.

- In terms of source of the change in carbon emissions, we look at the relationship between renewables and brown coal market share, and relationship with the market price.

18 February 2021 Edge Report (Subscriber Link)

- Review of the conditions withn Texas ERCOT in response to temperatures 20C below average (-10 to -20C).

- Electricity prices have been USD$9000/MWh for 100 hours – making this one of the most volatile commodity price events ever (~$10B/d turnover – whereas 3rd Feb was ~$11M/d).

- Relating back to Australia, we look at the interactions of the Cumulative Price Threshold (CPT).

1 March 2021 Edge Report (Subscriber Link)

- Update on the Iona Gas Storage which has lifted to 22.8PJ ahead of the 8th to 28th April maintenance.

- Investigation into the curious relationship between Brent Oil and AUD/USD Foreign Exchange Rates including the distribution cliff-edges and the periods of strong and weak correlation.

15 March 2021 Edge Report (Subscriber Link)

- Investigation into the gas price relationship between international gas and domestic gas market conditions.

- Coal Transition Update: Yallourn exit brought forward to 2028 and Liddell’s full exit shown within MTPASA.

- Comparison in terms of dispatched energy, spot revenue, dispatch weighted average prices and dispatch price ratios for Brown Coal, Natural Gas, Wind and Solar.

- Investigation into the dark spread for New South Wales Black Coal for Q1-2021 to date and a comparison of dispatch versus other Q1’s.

Request a sample of The Edge Energy Market Report via our Contact Us form.

CATEGORY: Consultancy and Advisory

TAGS:

Electricity Spot, Forecasting, Gas, LNG, Renewables, The Edge

APRIL 2021